How To Pay Your Income Tax In Malaysia. FRASA KESELAMATAN Mulai 27 Februari 2017 LHDNM akan meningkatkan keselamatan laman sesawang ezHASiL dengan memperkenalkan frasa keselamatan.

Telephone service Please provide us with your full name income tax number and telephone numbers when you contact us through phone.

. If youre a very busy person or if this is your first time doing this you might just forget to fill up that LHDN form on timePlease note that the deadlines for tax filing are 30th April 2022 and 15th May 2022 for manual filing and e-Filing respectively. Lembaga Hasil Dalam Negeri Malaysia LHDNM telah memaklumkan kepada semua pembayar cukai Tahunan Taksiran 2021 boleh mula mengisi E Filing. Mondays to Fridays 800 am to 500 pm.

For parents filing separately this deduction can only be claimed by either the childs mother or father. Recovering Bad Debts with Credit Manager and eTR Learn 18. How To File Your Taxes Manually In Malaysia.

Prosedur ini tidak terpakai kepada pembayar cukai yang membuat e-Filing melalui Ejen Cukai. How To File Income Tax As A Foreigner In Malaysia. Keep all your receipts.

Guide To Using LHDN e-Filing To File Your Income Tax. Tax Offences And Penalties In Malaysia. Peak Hours at LHDNM Customer Service Centre 1-800-88-5436 LHDN.

LHDN e-Filing Guide For Clueless Employees Learn Personal 16. Further education fees self. Failure to do so IRB will render an employer liable to.

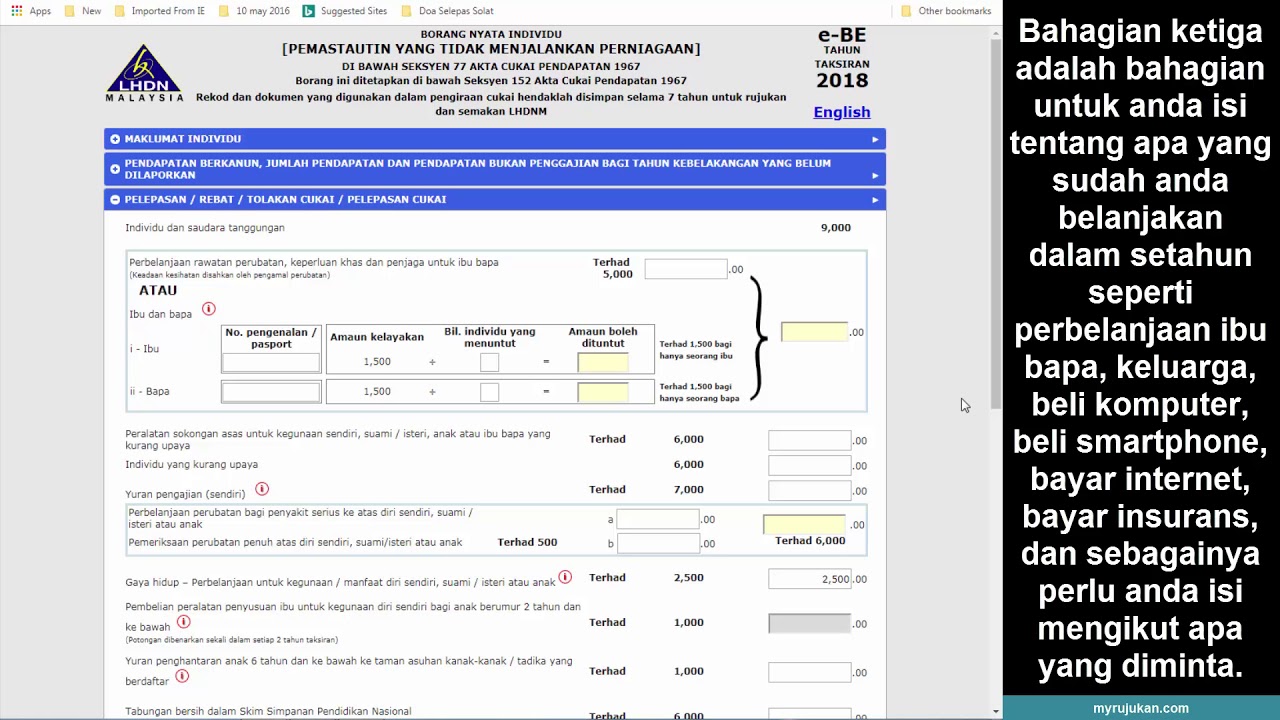

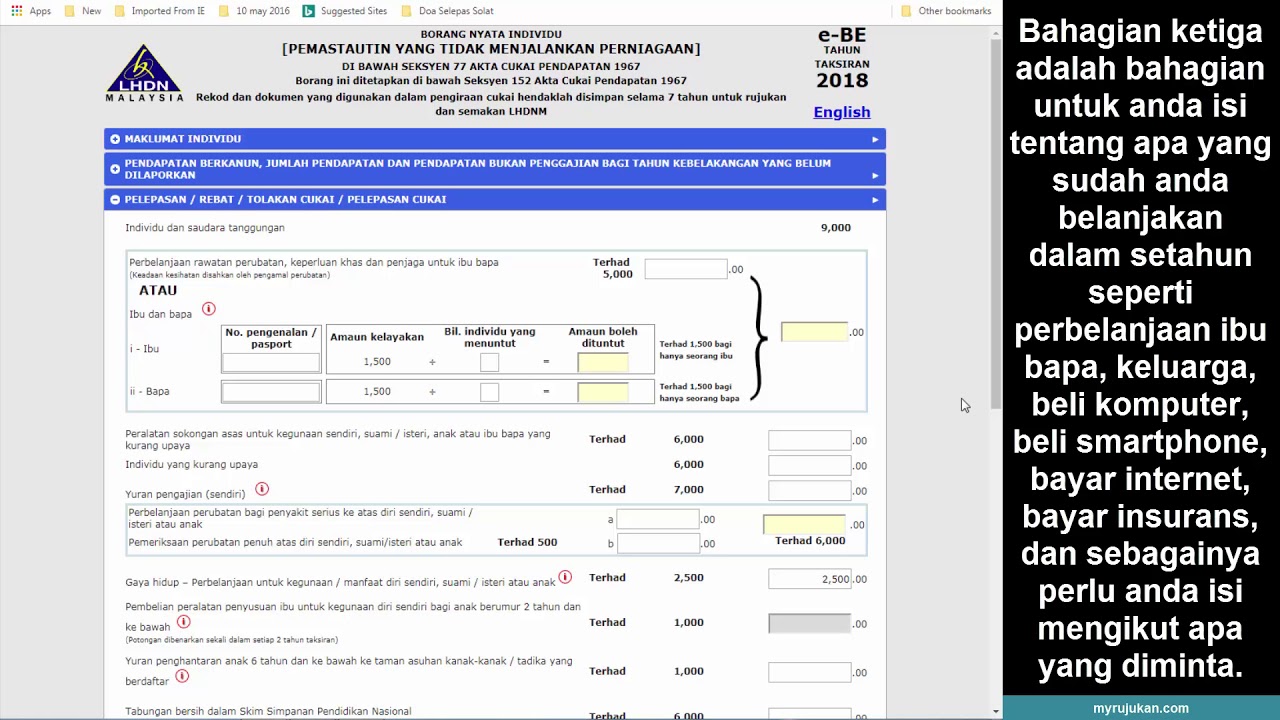

Penerbitan Pusat Penyelidikan Klinikal CRC Polisi pelawat melawat ini diperkenalkan adalah untuk memberi makluman serta pengetahuan mengenai peraturan peraturan yang ditetapkan di dalam kawasan Hospital Sultanah Nur Zahirah. Youre eligible for an automatic tax deduction of RM9000 just by filling in the LHDN e-Filing form. Frasa keselamatan adalah bertujuan untuk memastikan pembayar cukai log masuk ke laman sesawang ezHASiL yang.

CARA ISI E FILING 2022. PANDUAN LENGKAP CLAIM INCOME TAX BORANG BE. How To File Your Taxes Manually In Malaysia.

Please contact the nearest IRBM branch for your e-Filing consultation. Tax Offences And Penalties In Malaysia. Child aged 18.

How To File Income Tax As A Foreigner In Malaysia. Employer to submit Form CP22 which is Notification of new employees. Take note of the LHDN e-filling 2021 deadline.

Taking Charge of Your Creditworthiness Learn Personal 12. Guide To Using LHDN e-Filing To File Your Income Tax. How to improve your CTOS Score Learn Personal 15.

How To Pay Your Income Tax In Malaysia. The employer is obligated to inform the assessment branch of IRBM by filing and submitting a CP 22 form within one month from the date of commencement of an employment. Pembayar Cukai Taksiran Tahunan 2021 boleh mula mengisi E Filing LHDN bermula pada akan dikemaskini 2022.

As the name suggests this will be done automatically by the system.

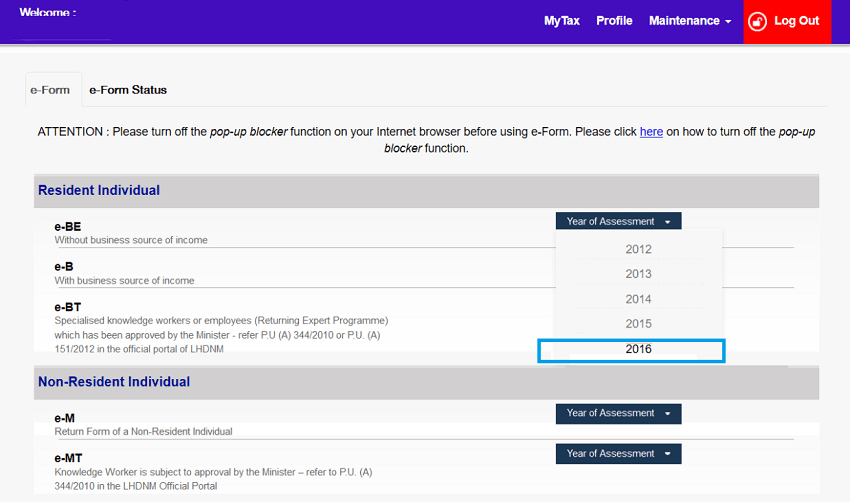

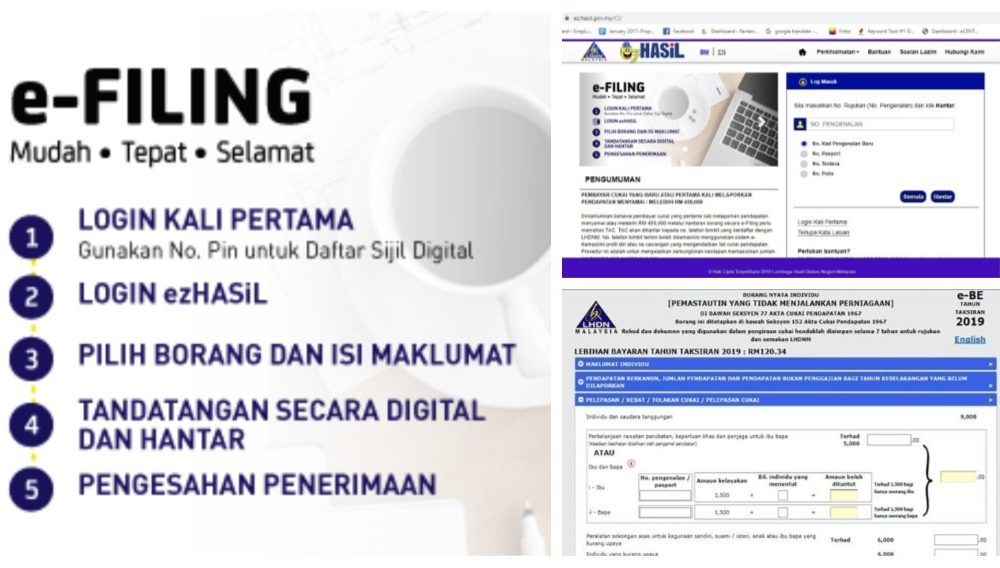

How To Step By Step Income Tax E Filing Guide Imoney

How To Step By Step Income Tax E Filing Guide Imoney

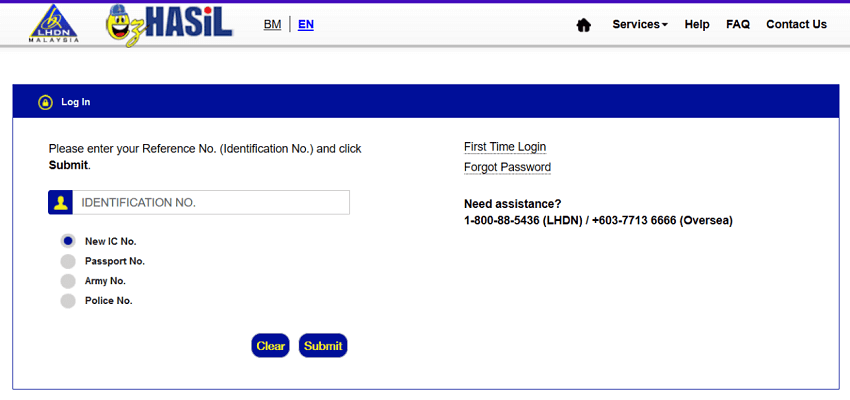

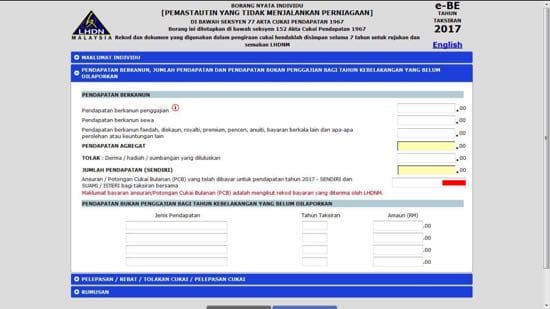

Jabatan Hasil Dalam Negeri E Filing Jaroncxt

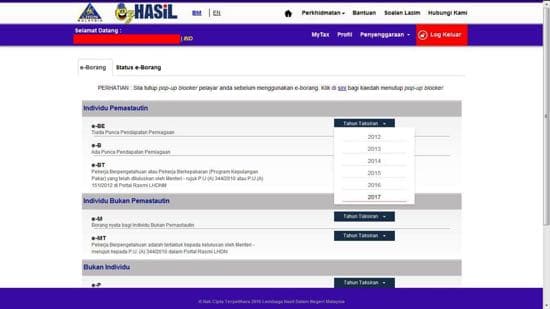

Lembaga Hasil Dalam Negeri Malaysia Kelebihan E Filing Facebook

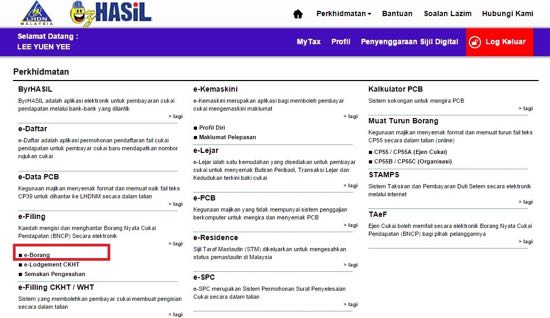

Ctos Lhdn E Filing Guide For Clueless Employees

Understanding Lhdn Form Ea Form E And Form Cp8d

Ctos Lhdn E Filing Guide For Clueless Employees

Lembaga Hasil Dalam Lembaga Hasil Dalam Negeri Malaysia

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

Cara Buat E Filing Cukai Pendapatan 2021 Untuk First Timer Mulai 1 Mac

Ctos Lhdn E Filing Guide For Clueless Employees

Ctos Lhdn E Filing Guide For Clueless Employees

Isi Cukai Pendapatan Melalui E Filing Lhdn Youtube

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

Sharing Is Power Dah Buat E Filing Lhdn Kena Bayar

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

Ctos Lhdn E Filing Guide For Clueless Employees